Characteristics of a Money Market Mutual Fund Include

Sixty-nine percent of individuals heading households that owned mutual funds were married or living with a partner 56 percent were college graduates and 75 percent worked full- or part-time. The significant financial return they offer also adds to their appeal.

Money Market Fund Investments.

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

. Most money market securities mature in less than three months time and all money market securities mature within one year. Characteristics of a money market mutual fund include. Liquidity-- Money market instruments are liquid investments which means that they can readily be bought and.

So look at a funds long term record. A required minimum balance of 2500. In addition money market instruments generally have the following two characteristics.

The purchase of shares by investors the proceeds of which are reinvested into liquid short-term securities. Factors to determine Interest Rates of Money Market Instruments. One particular type of fund limits its asset purchases to US.

The purchase of shares by investors the proceeds of which are reinvested into liquid short-term securities. Money Market helps in financial mobility by allowing easy transfer of funds from one sector to another. Federated Hermes Prime Cash Obligations Fund PCOXX.

The purchase of shares by investors the proceeds of which are reinvested into liquid short- term securities. Money market funds invest in short-term securities. Money market funds are regarded as being as safe as bank deposits yet they provide a.

By keeping a short time frame these funds attempt to reduce uncertainty which may help to manage risk. Money Market funds are steady return products with little risk of default. Money market funds generate.

The ability to be readily marketable. The ability to be readily marketable. Many investors prefer to park substantial amounts of cash in such funds for.

A money market fund is an open-ended mutual fund that invests in short-term debt securities. Click for Answer and Explanation. The third and largest class.

C the underlying portfolio consists of short-term debt instruments. Income generated by a money market fund is either taxable or tax-exempt depending on the types of securities the fund invests in. Money market mutual funds are among the lowest-volatility types of investments.

Among households owning mutual funds the median amount invested in mutual funds was 126700 Figure 72. When should you Invest in a Money Market Fund. Vanguard Treasury Money Market Fund VUSXX.

Do not get wrapped up in this years or even last years rates of return. Functions of the Money Market. Finance questions and answers.

Earn Up To 005 APY And Receive 200 When You Open A Money Market Account. Money market mutual funds are among the lowest-volatility types of investments. A money market mutual fund is a professionally managed fund that buys money market securities on behalf of individual investors.

A money market fund is one of the many assets dealt in the money market. Money market funds are fixed income mutual funds that invest in debt securities characterized by short maturities and minimal credit risk. This ensures transparency in the system.

The Best Money Market Funds of May 2022. The longer you lend money to a person business or government the greater. These funds tend to offer the benefits of stability and liquidity to their investors.

An outstanding long term return for the past 5 10 and 20 years. 3 tax liabilities for an investor are simplified because each year the fund distributs a From 1099 explaining taxability of distributions. A required minimum balance of 2500C.

Although they are issued by different borrowers money market securities share certain characteristics including safety and liquidity which is part of what makes them appealing to investors. Schwab Value Advantage Money Fund. Money market instruments such as federal funds and repurchase agreements exemplify the short maturity of money market securities.

All of the following are characteristics typical of a money market fund EXCEPT. Fundamental Attributes of Quality Mutual Funds. Money market funds are fixed income mutual funds that invest in debt securities characterized by short maturities and minimal credit risk.

Retail investors can gain indirect access to this market through money market funds Money Market Funds A money market fund is a form of short-term debt security or open-ended mutual fund with a shorter maturity offering good returns at high liquidity and low credit risk. It is a fund in which individuals can invest in order to receive an interest payment. Government securities and investments in various government-sponsored enterprises GSEs.

17 characteristics of a money market mutual fund. Money market funds are highly liquid and known for being a low-risk investing strategy used primarily by those who want to generate income in the short term rather than wait out a long-term investment. The money market contributes to the economic stability and development of a country by providing short-term liquidity to governments commercial banks and other large organizations.

Categories of Money Market Mutual Funds. High financial mobility is important for the overall growth of the economy by promoting industrial and commercial development. A money market fund is an open-ended mutual fund that invests in short-term debt securities and commercial paper.

Another class of money market funds purchases both US. The fund manager invests in money market instruments like treasury bills commercial paper certificate of deposits bills of exchange etc. A required minimum balance of 2500.

2 a fund may offer various withdrawal plans that allow different payment methods at redemption. Money market funds are a type of mutual fund that includes short-term debt securities. Mutual fund characteristics 1 new mutual funds being formed today must offer reinvestment of dividends and capital gains without a sales charge.

Characteristics of a money market mutual fund include A. Money market funds are widely regarded as being as safe as bank deposits yet. The money market fund deal only in cash and cash equivalents with an average maturity of an year with fixed income.

We are investing for the long term or you should be if you are considering mutual funds. Income generated by a money market fund is either taxable or tax-exempt depending on the types of securities the fund invests in. A its net asset value normally remains unchanged.

These funds cannot be easily marketable. Helps in monetary policy. We Offer Over 70 Funds With 4 5 Star Ratings From MorningStar.

These funds are required to keep investment maturities to 397 days or less. In the realm of mutual-fund-like investments money market funds are characterized as a low-risk low-return investment. Ad Keep Your Money Accessible W Low-Risk Money Market Funds.

Ad Watch Your Savings Grow While Having Easy Access to Your Money With Citizens Money Market. B it has a high beta and is safest in periods of low market volatility. D it is offered as a no-load investment.

They represent significant holdings in most money market funds and typically mature in less than. Characteristics of a money market mutual fund include.

Types Of Mutual Funds Mandiri Investasi

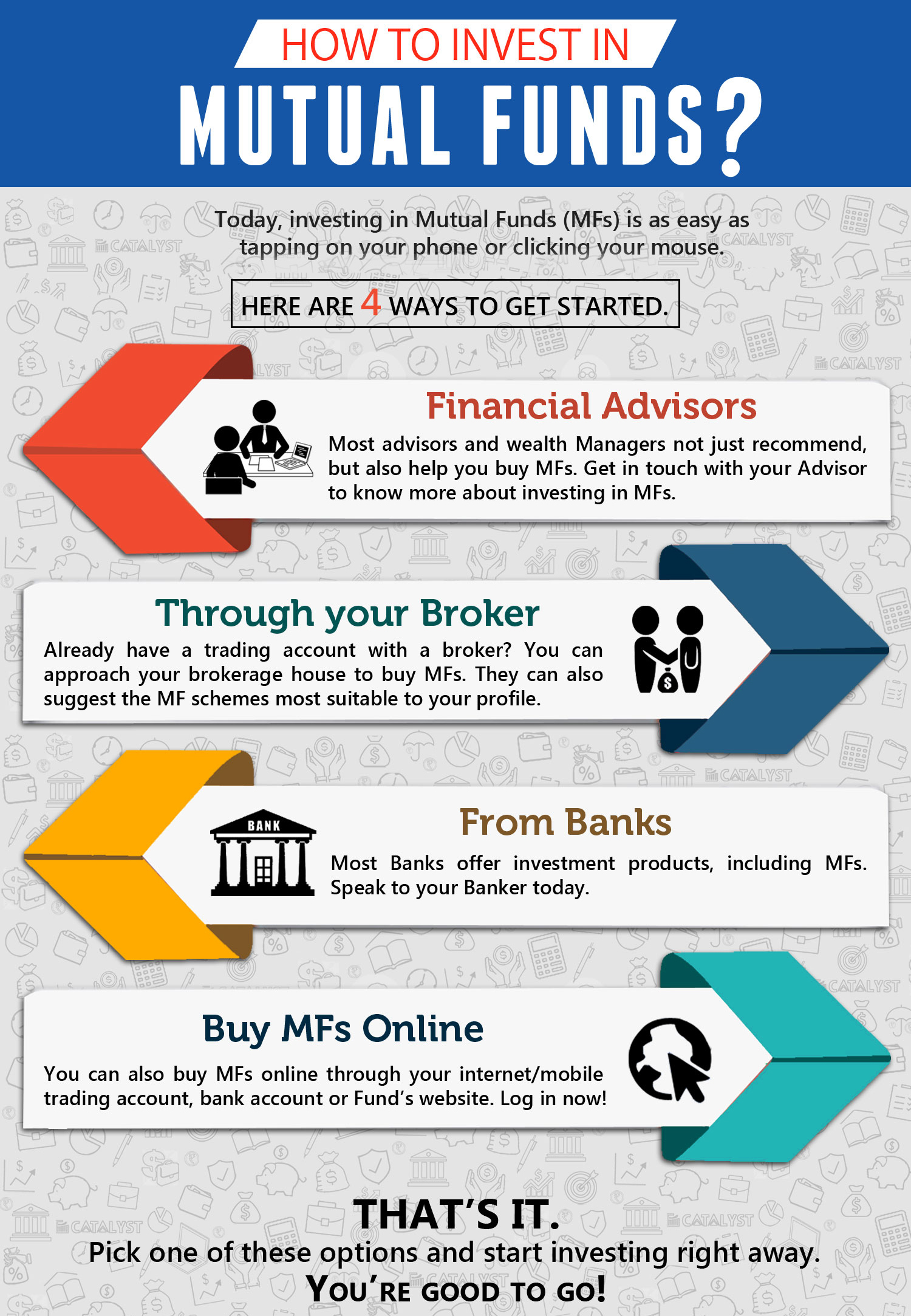

How To Invest In Mutual Funds Jamapunji

7 Things For Choosing The Best Mutual Fund Factors Affecting Mutual Fund Selection

/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

Comments

Post a Comment